We’re delighted to share that ECI Partners has been shortlisted in the PE House of the Year: Upper Mid-Cap category at the 2025 Real Deals Sustainable Investment Awards.

The Real Deals awards are among the most respected in the industry, celebrating excellence in ESG and sustainable investment practices across private equity. With an exceptionally strong field of entries this year, we’re proud to be recognised for our continued focus on responsible investing and long-term value creation.

Over the past year, we’ve continued to embed sustainability into everything we do, whether that’s through our portfolio-wide ESG action plans or the delivery of our first ever Impact Report at the end of last year. It’s fantastic to see this progress recognised in such a competitive category, and a testament to the hard work of our team and the ambitious management teams we partner with.

You can view the full shortlist here.

News

14/07/2025

ECI shortlisted for PE House of the Year at Sustainable Investment Awards

Isa Maidan recently attended the Phocuswright Conference 2025, where industry leaders and innovators gathered to discuss the future of travel. Unsurprisingly, AI was front of mind, almost all panels and presentations eventually found their way to our algorithmic friends. There was a lot of talk about what artificial intelligence could do, but what are customers doing today, what is coming imminently and what does the future look like?

What is being used today?

More and more customers are using AI to plan their holidays, using it to narrow destination options and plan broad itineraries for a trip. Whilst there isn’t data available on it, there was an agreement that LLMs are clearly part of younger customer decision making around travel. For many businesses, this represents an element of their customers’ journey that isn’t very well understood.

An interesting point to note, when people in the room were asked whether or not they had used AI to research holidays, most hands went up. When asked if they had actually booked the generated suggestion, most went back down. It’s important to take a pragmatic view that as of today, it hasn’t yet dramatically changed the booking process. However, for simpler bookings, the direction of travel is absolutely clear over the longer term.

What is imminent

The big one here: search.

The combination of a highly competitive market and customers’ strong purchase intent at the time of search has meant the travel industry has become highly reliant on PPC. As an investor, a key part of DD for many travel businesses in the last 10 years has been understanding their PPC capabilities and the sustainability of driving traffic through google. This is changing.

AI summaries are leading to fewer clicks and a shift away from Google into LLMs, which is understandably a concern for those who have optimised marketing for Google PPC. Going slightly further down the track, the recent trial and launch of Google AI mode (where search shows very few / no links) has led a lot of people to question what their future marketing spend looks like. More specifically, how do you optimise for a hyper personalised search into an algorithm that you don’t yet understand?

What is evident, is there is a significant opportunity here. Travel websites are complex, so it isn’t easy to transform a site to be optimised for GEO, but those that are agile and able to do so now will see the upside. Search disruption is also not necessarily a bad thing. A single engine dominating traffic has meant CAC often represents a significant portion of many travel businesses’ cost base. Given the general view is LLMs are likely to move to ads, a bit of competition in the search world is no bad thing.

Future

Agentic AI is the clear answer here, the idea being AI can search for, plan and book your perfect holiday based on your historical preferences and specific wants.

This raises significant questions and opportunities for a lot of travel businesses today. What does your business look like if at the extreme we move from a multi- step process today – (plan, search, browse, refine, transact) multiple times across the travel journey, to plan, review, book?

A further consideration that came up multiple times was the interplay between tech and trust. Historically customers have wanted solutions that tech wasn’t capable of delivering. Increasingly with AI it is looking like tech will be delivering solutions before customers trust it. With that in mind, rushing out a sub-optimal solution is not the answer here. Being a brand that is trusted and taking customers on that (improved) journey will be hugely important.

Whilst it’s currently unclear who the ultimate winners and losers are, what is clear is that there will be disruption and therefore opportunity ahead. As an investor, there is renewed focus on travel companies that are offering something that AI can’t easily compete with – high touch, personal, bespoke service and complex travel, where the trust threshold is high. If that isn’t your business model, it’s time to get on the front foot re AI.

If you would like to find out more about how we are helping travel brands grow, please get in touch.

Insights

10/07/2025

Isa Maidan

Read Time: Min

AI travel – today, tomorrow, the future

Stephen Roberts recently attended the CIPD Festival of Work which brought together nearly 13,000 professionals across HR, L&D, and leadership to explore the future of work. Stephen shares his key insights on how leaders in the HR sector are adapting to a rapidly changing landscape.

1. Engagement: your people are your customers

According to ADP’s 2024 global study, only 21% of employees are fully engaged at work. That means nearly 80% are not. Yet engagement is the single biggest driver of productivity and loyalty.

As Annabel Jones of ADP put it, HR teams need to think like account managers. Every employee is subscribing to your workplace - and they can churn if the experience doesn’t deliver. That means understanding what matters to each individual, in the context of their team and the wider organisation.

Quarterly pulse surveys are replacing outdated annual engagement reports, and HR software like Ciphr can help HR teams monitor engagement in real time and identify where to improve.

But surveys help you assess engagement, not deliver it. That comes down fundamentally to pay, progression, and purpose. If people can’t see a future in your organisation, they’ll find one elsewhere.

2. Investment skills: build a workforce that stays

According to ADP, only 17% of UK employees believe their employer invests in the skills they need to advance. That figure drops to 12% across Europe. Yet when employers do invest in training, workers are six times more likely to recommend them.

The most in-demand areas? Communication, leadership, and soft skills. These aren’t just “nice to have”- they’re essential for navigating change, managing teams, and driving performance.

There has been a growth in companies that are helping businesses build scalable training pipelines. But the real shift is cultural: from seeing training as a cost, to recognising it as a strategic investment in retention and growth.

3. AI adoption is a people challenge as well as a technical one

“AI won’t take your job - but people who use AI will.”

AI is a source of worry for many employees, while younger employees are more optimistic, many see it as a threat. The solution? Involve your people in how AI is introduced and used. Done right, AI should reduce stress, not to add to it, but people need to have clarity on why it isn’t a threat but a facilitator.

As Neil Pickering of UKG noted, AI adoption starts with understanding your own data and processes. Then it’s about removing friction - making AI easy to use, secure, and clearly beneficial.

At ECI, this is an area we actively support management teams with, identifying and facilitating the most valuable use cases for AI, in a way that can make their teams more productive, and engaged through spending their time on higher value tasks.

4. Trust and transparency over surveillance

Speakers noted that monitoring tools are on the rise, but they’re not always delivering the results leaders hope for. In fact, employees who feel watched are four times more likely to report low productivity.

The answer isn’t more surveillance - it’s clarity in communications. When people understand what’s expected of them, they perform better and feel less stressed.

OKRs or V2MOM are frameworks used throughout our portfolio to align teams around shared goals. But the real shift is mindset: trust your people to deliver, and they usually will.

As one speaker put it: “Are we using productivity tools to build a better business - or because we don’t trust our people?”

5. Boost the wellbeing of your team

In 2023/24, the UK lost an estimated 16.4 million working days to stress, depression, or anxiety. Burnout is a productivity killer and it’s often preventable.

Creating a culture where people feel safe, supported, and included isn’t just good ethics - it’s good business. That means normalising mental health conversations, training managers to spot the signs, and designing work in a way that supports balance.

Flexible working helps but only if it’s backed by trust and fairness. Nearly 30% of employees say they feel judged for using flexible policies. That needs to change.

If you’d like to chat to anyone about how we are working with HR Tech companies, and supporting companies to enhance their people and culture strategies, please get in touch.

Insights

03/07/2025

Stephen Roberts

Read Time: Min

How HR tech is boosting engagement

Despite the significant challenges posed by US tariffs, does the recent executive order signed by President Trump on US-UK trade create any opportunities for UK companies?

While we are in an era where anything can change any moment, Lewis Bantin looks at the current state of the market, and where there may be some opportunities for those in the UK.

1. Potential for increased competitiveness for UK exports

While the UK faces a 10% baseline tariff on most goods exported to the US, this rate is notably lower than the reciprocal tariffs imposed on many of the UK’s key competitors.

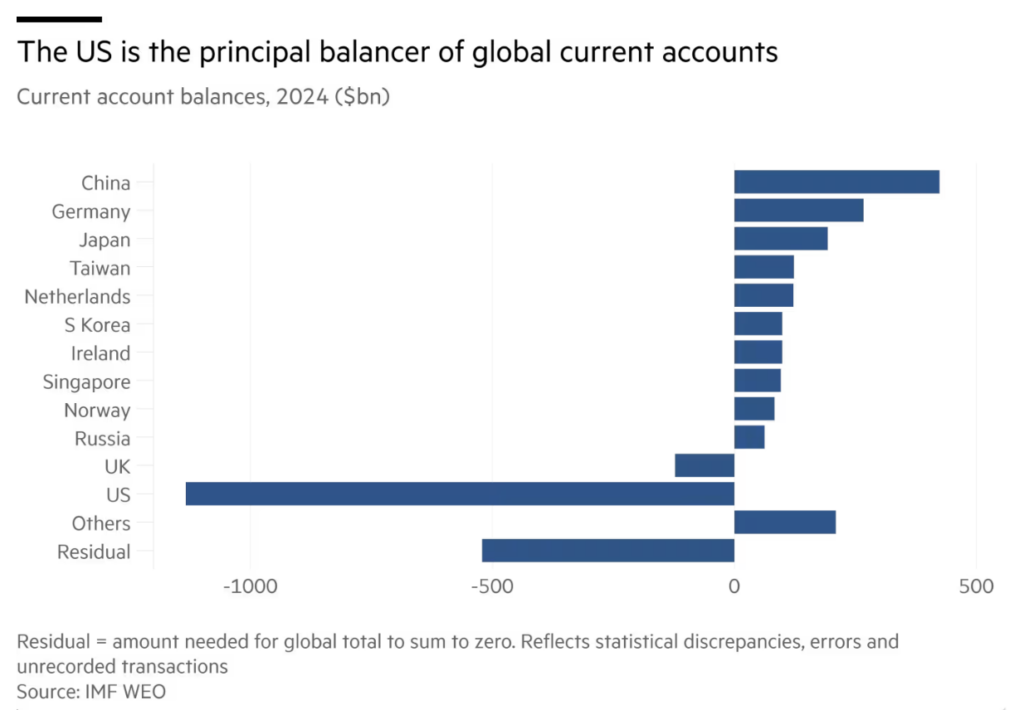

Given the state of the global current account (im)balance (see IMF analysis below), Trump has hit Europe with a 50% tariff on steel and aluminium and a 25% levy on cars; the EU is trying to secure a deal before July 9, when reciprocal tariffs on most other goods would rise from 10% to up to 50%. For China, US tariffs will be set at 55%.

Depending on the final rate of reciprocal tariffs, the differential could make UK exports to the US comparatively cheaper, creating a ‘least bad option’ advantage. Similarly, with the EU looking at a minimum of 10% reciprocal tariffs on the US, EU buyers of software may look to the UK for service given the immediate price advantage, but also, and perhaps more importantly, greater predictability about future cost. In the meantime, you may also see a benefit for companies, such as Moneypenny, that are operating across both regions with a US and an UK HQ.

2. Opportunities arising from new US-UK trade deals focusing on digital trade

The recent UK-US Economic Prosperity Deal, announced on May 8, 2025, represents a significant development. While it did not fully resolve the Digital Services Tax issue, it explicitly establishes a foundation for a deeper relationship with a strong focus on technology. This agreement includes a platform for future negotiations on digital trade, critical minerals, and economic security.

The stated objective is to “strip back paperwork for British firms trying to export to the US”, with the potential to open a vast (US) market and significantly boost the UK economy. This suggests avenues for deeper collaboration in areas such as AI and quantum technologies. The explicit emphasis on a “digital trade deal” and “technology partnership” signals a clear recognition by both governments of the growing importance of the digital economy. This is good news for UK software companies, especially if it leads to a more streamlined regulatory environment, allowing them to access more of the global market. This will especially benefit those that have shifted away from hardware, for example Peoplesafe have shifted from hardware to cloud-based application, which has seen a 158% growth in app sale requirements compared with 30% for devices since 2022.

3. The drive for accelerated AI adoption and operational efficiencies

The cost pressures, supply chain disruptions, and market restrictions imposed by tariffs are compelling businesses across various sectors to seek greater cost efficiencies and re-engineer their processes. This environment creates a strong incentive for the accelerated adoption of AI to improve both the productivity of internal process as well as open new use cases for services.

With a wealth of UK and European software companies specialising in these areas, there is an opportunity to sell to those looking to mitigate tariff impacts through digital transformation and the outsourcing of “non-core” services to niche expert providers.

4. Supply chain shifts

Tariffs can induce sudden shifts in global demand and supply patterns, leading businesses to actively move away from exposure to “tariff-heavy” regions of the world. This dynamic could present opportunities for UK-based companies to benefit from a higher supply of, and potentially cheaper prices for, tech goods and components that were previously destined for the US. This also generates new demand for software solutions that assist businesses in managing increasingly complex and diversified global supply chains.

There is a chance that we may see more foreign investment in the UK tech sector as companies in other locations with higher tariff rates look to relocate to take advantage of the comparably lower rates in the UK – assuming, of course, that the “new normal” of global tariffs persists. However, this will all come out in the wash in the medium to long-term, depending on the rates imposed, and whether they stick.

No one wants to operate in a protectionist world; it limits global trade and hinders predictability, which is damaging to business and investment decisions.

However, despite this complex and dynamic environment, the UK is relatively well placed and recognises its need to trade in an agile way. UK companies should be on the lookout for opportunities coming out of this wider climate.

Insights

30/06/2025

What opportunities will global tariffs create for UK companies?

Suzanne Pike, Partner in ECI's Origination Team, highlights the resilience of the mid-market amidst shifting trends across the PE landscape, according to ECI's latest data analysis.

With 14 buyouts completed in the £150 – 300 million range across the trailing 12 months (TTM) to Q1 2025, up from 13 in Q4 2024 and 12 in Q3 2024, the sector has remained consistent with its long-term average of 14 deals completed per quarter since 2021, reflecting stability in the market.

The large-cap end of the private equity market, over £300 million, has seen a reduction in activity, with the number of completed buyouts in single digits, not helped by a clogged IPO market for exits. This has, in turn, caused larger funds to dip down into the mid-market, where there is more activity. Meanwhile, smaller-cap buyouts – firms valued up to £150 million - have dropped significantly, with only 26 transactions in Q1 2025 compared to 37 in Q4 2024 and 38 in Q3 2024.

Despite broader macro challenges, ECI highlights the importance of the flight to quality over quantity in private equity investments. High-performing companies are commanding high valuations as investors seek out companies with robust management strategies and solid growth trajectories.

ECI completed five deals in the 12 months to the end of March 2025, outperforming mid-market private equity during this period.

News

24/06/2025

Mid-market proves resilient amid economic uncertainty

Expanding your business into the US market can be a transformative step, but only if you ensure your go-to-market strategy has the right foundations. A critical part of this strategy is building out an in-market US sales capability, not only hiring the right people but also giving them the right tools to sell your solutions. We ask Brett Pentz, ECI’s Growth Specialist for North America, where he has seen management teams do this well and what are the key considerations.

1. Why should you win in the US market?

Because the US is such an attractive market, it can be easier to focus on the benefits to the business of you being there, rather than to your potential customers. Many businesses make the faulty assumption that their solution will immediately translate to the US. Leadership teams need to have a clear view as to product-market-fit, why you have a right to win customers in what can be a different market, and what subtle components of product localisation might be needed. This first step is crucial and will have a benefit when you go out to hire roles and can explain the potential. At CPOMS, we spent time and effort to conduct substantial interview and survey research with prospective buyers and users to understand their needs when it came to school safety software. This allowed the business to prioritise some small but critical changes to their marketing collateral and product to be successful with US school districts.

2. Where should you sell?

One of the ways I help management teams with US expansion is deciding where they should first launch or which new regions to enter, in particular where to open offices. There are several factors that feed into that decision from the presence of ideal customer profiles to logistics to total costs, but the availability of potential talent, including sales, is a key consideration. Moneypenny is a great example, where operating from Metro Atlanta has proven to be target-rich in the legal, healthcare, home services, and other businesses that they serve and talent-rich in recruiting the sales team and other roles.

It’s also important to understand what a competitive compensation package looks like by metropolitan area, while remembering that not only will the US often have much higher salary expectations than Europe, but it can also vary dramatically from one location to the next. You will also need to consider the full compensation package, including commission targets, retirement accounts, employee stock options, health insurance, remote work flexibility – and much more, all in line with expectations of that local market. You may need to be prepared to pay up; trying to undercut a market you’re trying to break into is unlikely to deliver a long-term return on expansion.

3. Are you being sold to?

Assessing sales talent in any country is inevitably difficult - they’re just so good at selling themselves! But this may be more true in the US than anywhere else based on my travels. It is important to get a good feel for multiple candidates so you can do a proper side-by-side comparison, rather than comparing to your UK sales team. It’s also important to align your hiring process to your company culture, assessing for behaviours and values, rather than just looking at historic numbers. Hiring into a US office that is establishing itself in the market is more akin to hiring into a startup, so the skills to hire for should be different with those first US hires. The more that individuals from your business, or a partner like me, can spend in the market to try and reference and get to know salespeople before a hiring process, the greater the chances of successfully being able to find and attract the right talent. Better yet, go to a relevant conference or event for target customers in the US, and observe firsthand who is effectively selling in your industry.

4. Who should be your first hire?

It is easy to imagine that one superstar hire who knows everyone in the industry can forge an entire sales function, but that assumption can be an expensive mistake. Not only do you add high cost into a function that is just getting started, but often a different level of hustle and hunger is needed when trying to build something from the ground up versus operating within a larger enterprise. What an individual can do at one company may well not translate to your business that is nascent in a new market. These individuals can be introduced once networks and brand reputation already have a foothold, and operations are established to set them up for success. Moreover, we have found businesses should be open and prepared to be flexible when the right person is identified, even if the timing isn’t exactly right. At Peoplesafe, the right answer was not to try to find a salesperson that worked for a large US competitor, but rather to find someone that was effectively selling a completely different type of technology solution to the same types of buyers that fit into Peoplesafe’s go-to-market strategy.

5. Where are the leads coming from?

A sales team needs high quality lead generation to be able to sell your product, and this is especially true in the competitive US market. Word of mouth takes a long time, so you will need to allocate significant marketing budget, and create a seamless process for lead qualification that means teams are focussing their efforts on those most likely to convert. It is critical to map that process to build an effective sales and marketing engine from awareness to qualification to conversion. Don’t be in a rush to hire a US sales lead, but rather take the time to rebuild this engine to reflect each high-priority US customer segment. Then, once you have established a sustainable pipeline of qualified leads, you can bring in a US salesperson that is now set up for success.

Insights

11/06/2025

Brett Pentz

Read Time: Min

Setting a US sales team up for success

In our latest Quick Fire, we chat with ECI’s Origination Analyst, Sam Veevers, about his journey into private equity, the reality of AI adoption, and why his browser tabs are getting out of hand.

Q: What made you want to join ECI?

I’ve always been someone who values learning and development, so I was immediately drawn to ECI’s approach. It was clear that personal growth was something they took seriously, and they’ve absolutely delivered on that promise. Ten months in, I’ve picked up more skills than I can count and, with ECI’s support, I’ve recently enrolled in an AI/ML programme at Cambridge.

I was also really impressed by how connected the teams are here. The Origination, Commercial and Investment teams don’t work in silos, they operate as one, and wins are shared across the board. That kind of collaboration really stood out to me.

Q: How do you leverage AI as part of your role?

Personally, I use AI to streamline the origination and research process. Whether it's classifying companies, structuring web data, or enriching our pipeline with real-time insights, I’ve built several LLM-powered workflows to help us cut through the noise and identify high-fit opportunities at scale.

At a broader level, ECI has taken a proactive approach to embedding machine learning across the business through Amplifind™, our AI-powered origination engine that uses proprietary data to source, prioritise and assess leads. Over the past year, we’ve expanded it with modules like Amplifind™360, which uses AI to drive better decision making and collaboration for our portfolio on M&A prospects and pipeline. We’ve also introduced agentic tools that can intelligently source and compile relevant information. The goal is to eliminate low-value manual work and free up time for what really matters: critical thinking and decision-making.

Q: What have been some of the biggest changes you've seen with AI in the wider market since you joined?

It’s been exciting to see how much the landscape has shifted even just in the past year. We’ve moved beyond basic chatbot-style tools to much more sophisticated, workflow-integrated AI solutions. I think that shift has been driven by two things: better access to low/no-code platforms and a big jump in general AI literacy across the workforce.

That said, one major bottleneck for many businesses is still the quality of their internal data. As they say, bad data in, bad data out. What gives ECI a real edge here is that we’ve spent years investing in how we structure and store data. That head start has allowed us to use AI tools more effectively and get meaningful outputs much faster.

Q: What are your predictions for the M&A market in 2025?

Coming into 2025, many in the market felt that it was likely to be a busier H2, and so far, that reflects what we have seen. Q1 was relatively quiet across the board, as many businesses were still grappling with uncertainty whether that was around inflation, interest rates or wider macroeconomic conditions. That quieter period gave us, and many others, space to focus on strategic priorities, including embedding and supporting our four new portfolio companies from a busy deal period at the end of last year.

Now, it feels like momentum is building across the market. The pipeline is stronger, conversations are more advanced, and processes that may have been paused last year are beginning to move forward again. That said, there’s still a sense that some sellers are waiting for that “perfect” moment perhaps due to economic uncertainty or timing. Hopefully a calmer and more positive economic and political backdrop will lead to more confidence that now is a good time to come to market.

Q: Where would you like to be in 10 years?

Honestly, that’s a tough one to answer... If the past 10 years have taught me anything, it’s that your path can take a lot of unexpected and exciting turns. For me, the focus isn’t on a specific title or destination it’s about staying challenged, learning new things, and being part of something that feels impactful. As long as I’ve got that, I’ll be happy.

Quick Fire with Sam:

Are you an introvert or an extrovert?

Definitely an introvert.

What's the best bit of advice you have received?

“Everything happens for a reason.” It’s something my mum drilled into me growing up. I didn’t always appreciate it back then, but it’s stuck with me. When things don’t go your way, it’s easy to spiral so that little reminder helps me pause and put things in perspective.

Where are we likely to find you on a Friday night?

Fridays are usually a quiet night for me – working out, nice food and general ‘me time’ are among the typical agenda. With the level of quietness being largely influenced by Thursday nights activities – after all Thursdays are the new Fridays!

What is your worst habit?

I tend to hoard Chrome tabs throughout the day ‘just in case’ I need them later. Fast forward a few hours, and I’ve got 237 tabs open across five windows, wondering why my laptop’s fan sounds like a jet engine.

Who would you most like to have dinner with?

Probably the Egyptian Pharaoh Khufu (commissioned the Great Pyramid of Giza). So many questions, so many YouTube videos to debunk.

News

05/06/2025

Read Time: Min

“Quick Fire” with Sam Veevers

Croud, the digital-first marketing company, is pleased to announce the appointment of Steve King as its new Chair of the Board. King will play a key role in guiding Croud through its next phase of growth — helping to lead with innovation, scale the business, deepen client partnerships, and strengthen Croud’s position as a leader in delivering data-driven marketing.

Steve King brings over two decades of global leadership experience, having founded Zenith in the UK and the US, establishing its presence on both sides of the Atlantic. He served on the Board of Publicis Groupe for more than 20 years, where he led the global launch of Publicis Media and later served as Global Chief Operating Officer.

King takes over from advertising veteran Jerry Buhlman, who steps down after five transformative years. He played a key role in the business as it expanded its reach geographically with several US acquisitions, and across capabilities, acquiring Born Social, Vert Digital and MetaGeni. He oversaw Croud’s growth trajectory which resulted in the successful investment by ECI in October last year. Jerry will continue to be involved in the business as a special advisor to the Board.

This new leadership appointment comes at a pivotal moment for Croud as it launches its market-leading AI-powered platform, powering the new proposition to ‘Deliver a Return on Intelligence’. The proposition fuses its people, technology and AI capabilities organised to deliver incremental and commercial returns. The company has invested heavily in key leadership and new technologies, integrating these into its brand and performance media, as well as creative offering.

He joins Croud, as the company leads with:

- Market-leading tools and technology: Croud OS, a proprietary operating system that’s fully embedded into client delivery and designed to drive measurable marketing effectiveness, with key tools like Brand AI and SEO.Max.

- The Croudie Network: A standout model offering a globally distributed, flexible, scalable resource aligned to marketing plans – a level of sophistication unique in the industry.

- Top-Tier leadership: The recent appointment of Debbie Ellison, as EMEA CEO, Char Hamill as new EMEA COO and Kris Tait stepping up into the new role of Chief Business Officer, having built a strong base for the US business to grow. The appointments follow an objective over the last 12-18 months to bring in strategic leaders from across the industry.

News

04/06/2025

Croud signals next chapter of growth with advertising leader Steve King named as Chair