Despite the significant challenges posed by US tariffs, does the recent executive order signed by President Trump on US-UK trade create any opportunities for UK companies?

While we are in an era where anything can change any moment, Lewis Bantin looks at the current state of the market, and where there may be some opportunities for those in the UK.

1. Potential for increased competitiveness for UK exports

While the UK faces a 10% baseline tariff on most goods exported to the US, this rate is notably lower than the reciprocal tariffs imposed on many of the UK’s key competitors.

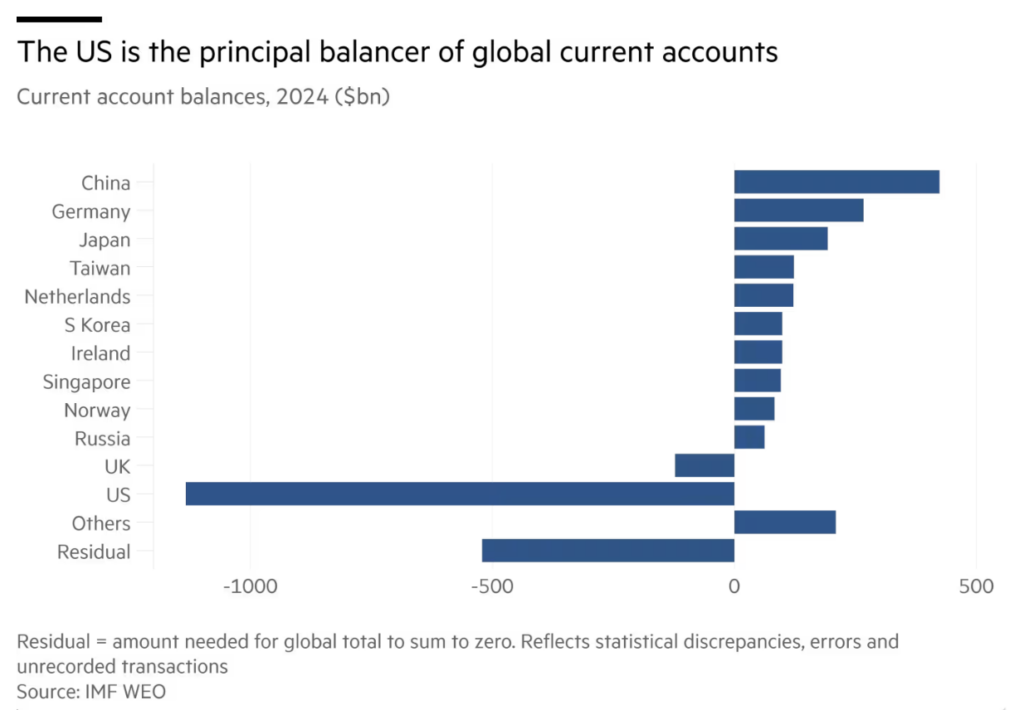

Given the state of the global current account (im)balance (see IMF analysis below), Trump has hit Europe with a 50% tariff on steel and aluminium and a 25% levy on cars; the EU is trying to secure a deal before July 9, when reciprocal tariffs on most other goods would rise from 10% to up to 50%. For China, US tariffs will be set at 55%.

Depending on the final rate of reciprocal tariffs, the differential could make UK exports to the US comparatively cheaper, creating a ‘least bad option’ advantage. Similarly, with the EU looking at a minimum of 10% reciprocal tariffs on the US, EU buyers of software may look to the UK for service given the immediate price advantage, but also, and perhaps more importantly, greater predictability about future cost. In the meantime, you may also see a benefit for companies, such as Moneypenny, that are operating across both regions with a US and an UK HQ.

2. Opportunities arising from new US-UK trade deals focusing on digital trade

The recent UK-US Economic Prosperity Deal, announced on May 8, 2025, represents a significant development. While it did not fully resolve the Digital Services Tax issue, it explicitly establishes a foundation for a deeper relationship with a strong focus on technology. This agreement includes a platform for future negotiations on digital trade, critical minerals, and economic security.

The stated objective is to “strip back paperwork for British firms trying to export to the US”, with the potential to open a vast (US) market and significantly boost the UK economy. This suggests avenues for deeper collaboration in areas such as AI and quantum technologies. The explicit emphasis on a “digital trade deal” and “technology partnership” signals a clear recognition by both governments of the growing importance of the digital economy. This is good news for UK software companies, especially if it leads to a more streamlined regulatory environment, allowing them to access more of the global market. This will especially benefit those that have shifted away from hardware, for example Peoplesafe have shifted from hardware to cloud-based application, which has seen a 158% growth in app sale requirements compared with 30% for devices since 2022.

3. The drive for accelerated AI adoption and operational efficiencies

The cost pressures, supply chain disruptions, and market restrictions imposed by tariffs are compelling businesses across various sectors to seek greater cost efficiencies and re-engineer their processes. This environment creates a strong incentive for the accelerated adoption of AI to improve both the productivity of internal process as well as open new use cases for services.

With a wealth of UK and European software companies specialising in these areas, there is an opportunity to sell to those looking to mitigate tariff impacts through digital transformation and the outsourcing of “non-core” services to niche expert providers.

4. Supply chain shifts

Tariffs can induce sudden shifts in global demand and supply patterns, leading businesses to actively move away from exposure to “tariff-heavy” regions of the world. This dynamic could present opportunities for UK-based companies to benefit from a higher supply of, and potentially cheaper prices for, tech goods and components that were previously destined for the US. This also generates new demand for software solutions that assist businesses in managing increasingly complex and diversified global supply chains.

There is a chance that we may see more foreign investment in the UK tech sector as companies in other locations with higher tariff rates look to relocate to take advantage of the comparably lower rates in the UK – assuming, of course, that the “new normal” of global tariffs persists. However, this will all come out in the wash in the medium to long-term, depending on the rates imposed, and whether they stick.

No one wants to operate in a protectionist world; it limits global trade and hinders predictability, which is damaging to business and investment decisions.

However, despite this complex and dynamic environment, the UK is relatively well placed and recognises its need to trade in an agile way. UK companies should be on the lookout for opportunities coming out of this wider climate.