In the ever-evolving landscape of the travel industry, the sector faces both challenges and opportunities this year. ECI Partner, George Moss, delves into three areas that excite him and will shape the future of travel: resilient demand, evolving preferences, and tech advances.

1. Resilient demand

Despite economic uncertainties, the market for travel remains robust. Pent-up demand, flexible working arrangements, and a continued preference for experiences over possessions are driving this resilience, with passenger traffic at Europe’s Airports reaching nearly 95% of pre-pandemic levels in 2023.

Expenditure on holidays remains a resilient area of consumer spending, with travellers protecting their holidays, so they have something to look forward to. As a result, forecasts for the longer term future are positive as travel and tourism GDP is predicted to grow an average of 5.8% p.a. until 2032, outpacing overall economic growth at 2.7% p.a.

However, it’s essential to acknowledge the challenges in the sector, particularly the widespread and prolonged industry labour shortages, consumers becoming increasingly price-conscious and ‘permanxiety’ a long-lasting hangover from the pandemic and fuelled by geo-political tensions.

Travel firms offering value for money, package deals, early booking discounts and flexibility will be well-positioned. But the imbalance in labour supply (62m travel and tourism jobs were lost in 2020 and 11% of jobs in Europe remain unfilled) coupled with increasing demand could potentially constrain the trajectory of growth and lead to brand reputational issues. It’s therefore critical the industry makes the most of available technology to provide customers with a digitally enhanced experience and tackle staff shortages.

2. Evolving preferences

2024 will continue to see consumer preferences evolve, requiring businesses to demonstrate agility in meeting the changing demands of travellers.

Millennials are the largest generation cohort in the UK and are driving the increasing trend in seeking authentic, immersive and Instagrammable experiences over ticking off bucket list destinations. They often place emphasis on finding unique cultural experiences, local tours and activities that connect with nature.

Sustainable travel is also fast becoming a major travel consideration. Pollution and rising carbon emissions linked to modern travel continue to be a concern, and with 2024 set to be the worst year for over-tourism, it’s driving 76% of consumers to want their next trip to be more sustainable. Accordingly, accelerating sustainability by highlighting eco-friendly practices, responsible tourism initiatives and carbon offsetting will be important.

Further to this, (and despite recent steps by some larger corporates towards more office time), a level of remote working is clearly here to stay, cementing the status of the Digital Nomad and impacting travel trends. The number of global Digital Nomads is expected to hit 60m by 2030, and some estimates suggest that 40% of the global workforce have access to remote or hybrid working. The trend for Digital Nomads to travel more and take longer trips will help fuel sector growth and we’re likely to see the emergence of more specialist operators like Selina, who specifically cater for their needs.

3. Technological advancements

Innovation in technology will continue to revolutionise the travel industry this year, presenting opportunities for companies to enhance customer experiences, drive operational efficiency and address recruitment challenges.

Personalisation is no longer considered a luxury, with 76% of travellers frustrated when providers don’t make recommendations and deliver personal interactions. And with 64% using or wanting to use AI to plan their travel, bespoke is becoming an important consideration. With additional research showing that 85% of millennials and Gen Zers consider themselves travel hackers, using tech and data that can personalise travel recommendations, curate tailored itineraries, and offer dynamic pricing based on individual preferences will be important to driving growth and customer loyalty.

Virtual reality (VR) and augmented reality (AR) experiences are increasingly being integrated into travel planning, offering immersive previews of destinations and activities. Examples include applications like Google Lens providing real-time translations, and many others allowing VR tours of destinations amongst other things. But it not just tourists. Airline and hotel operators are using VR too. For example, Emirates is personalising and gamifying training for flight crews to reduce the timeframe for onboarding new recruits.

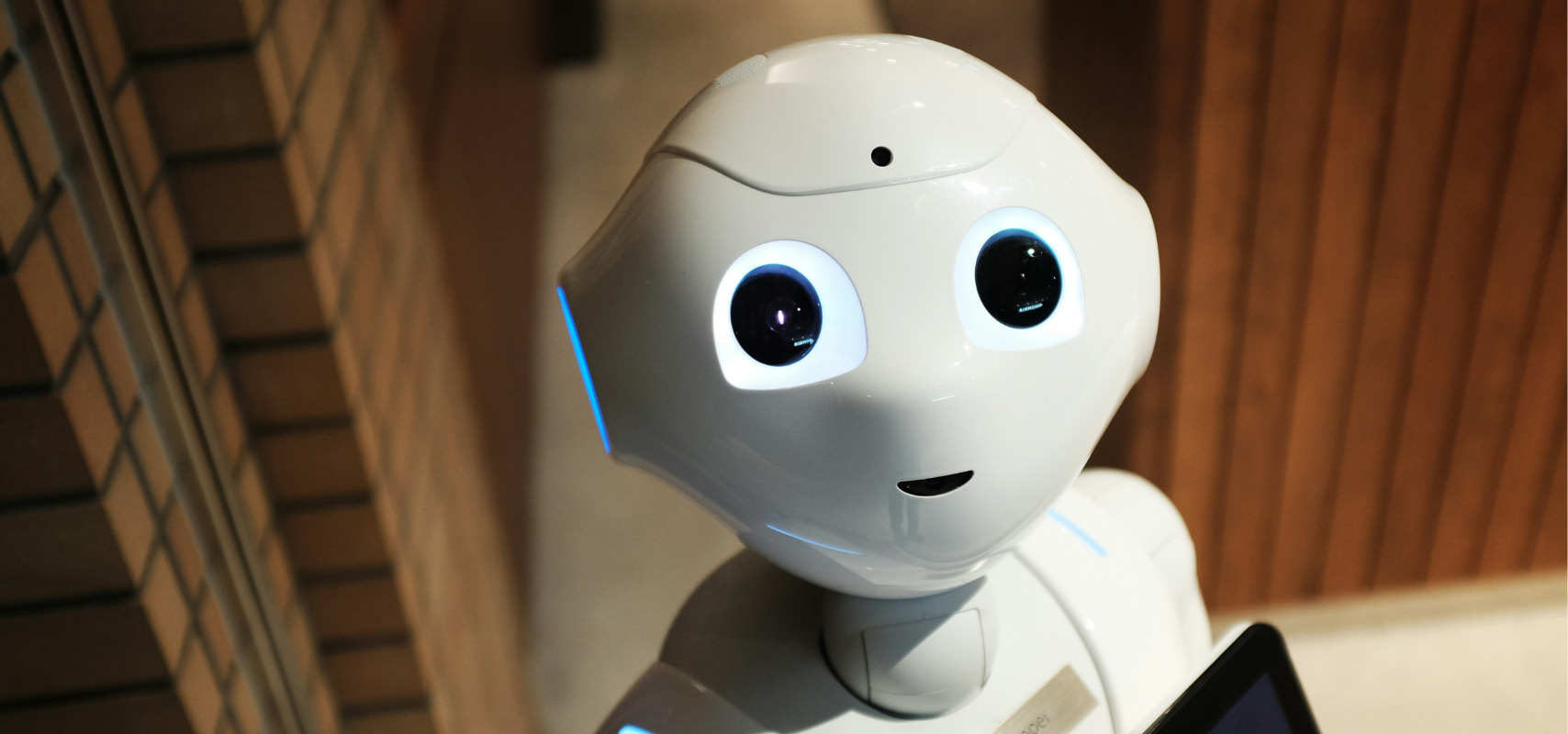

Recruitment challenges are also likely to be addressed by robotics, which are set to revolutionise logistics and guest services, with examples including Relay Robotics partnering with Hilton Hotels to use robots to deliver luggage to guests’ rooms, answer questions and provide directions. Almost 50% of the world’s airlines and a third of its airports are looking to invest in robotics and automated vehicles with, for example, Schiphol Airport investing in 19 baggage handling robots after a successful trial last year.

Remaining agile to drive growth

While growing strongly post-Covid, the European travel industry must continue to invest in innovation to remain competitive and resilient in a rapidly changing landscape. By understanding and catering to evolving consumer preferences (especially for flexibility and value in today’s market) and, leveraging advances in tech, companies can unlock success and thrive in the years to come.