If you read the media, it’s all been a bit doom and gloom in the tech sector over the last year or so. Whether discussing company growth, deal volumes, or valuations, the sector seems to have been under a bit of a grey cloud. But how accurate is that picture and how does it impact mid-market tech? Michael Butler shares his views on the state of the tech sector today.

Is tech sector doom and gloom justified?

The big tech sell-off

A lot of the negativity around tech investing has been driven by attention-grabbing headlines. In particular, this has focussed on the Big Tech Sell Off on the public markets, with tech stocks on the Nasdaq down 33% on 2022. Many of the markets’ favourite tech firms, FAANG (Facebook, Apple, Amazon, Netflix, and Google) and Microsoft, lost nearly $3.3 trillion in combined market value in late 2022.

So, it’s not surprising people weren’t feeling optimistic about the tech outlook going into 2023. But, where are we actually in Q4 2023?

If we take a look at the iShares Global Tech ETF, we can see the price drop in early 2022 came after a tech/digital surge during lockdown as everything went online. But, come 2023? We are now right back at the 2021 peak and more than 50% higher than pre-Covid.

Looking at valuation multiples, the Nasdaq-100 index has been trading at just over 30x TTM P/E in recent months. Whilst this is still someway short of the 40x peak in 2021, it remains materially higher than pre-covid levels which were averaging in the mid-20s.

Bumpy tech-pricing over the last 3 years has led to dramatic headlines, but taken holistically demonstrates a strong appetite continues for global tech.

Layoffs vs growth

Big tech layoffs have continued to dominate the press – indicating to many a sector that had grown too rapidly and failed to deliver on ambitious plans such as us all taking meetings in the Metaverse from our self-driving car.

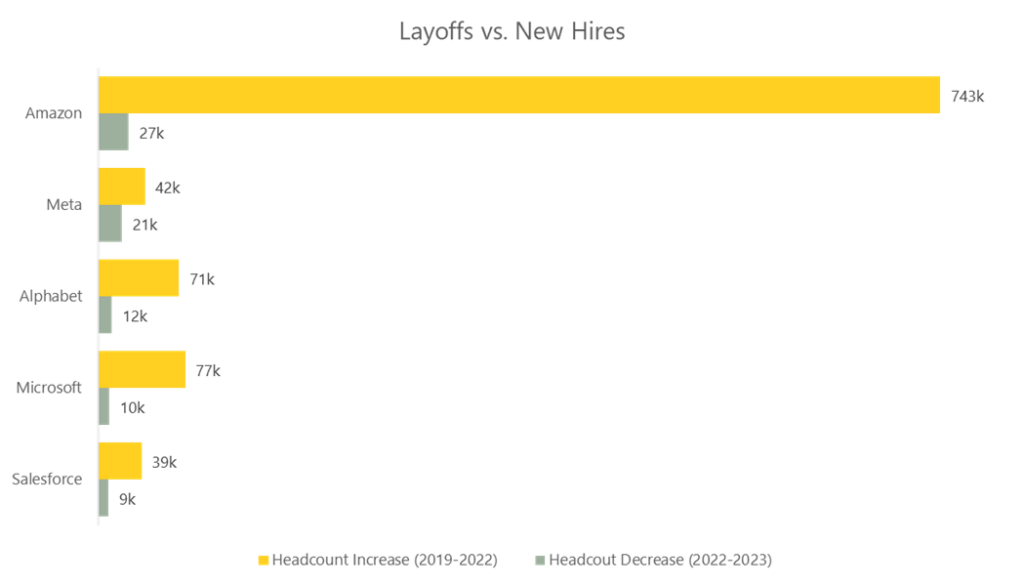

But when looking at the 5 largest culprits (collectively 42% of all tech layoffs), the hundreds of thousands of employees let go represent only 8% of the total roles they hired during the pandemic.

VC struggles

There is little doubt that when looking at tech startups, the universe is much more challenging. There was a time when the sector valued growth more highly than profit, but investors have been burned by the likes of WeWork, the macro environment has become more challenging, and capital has become more expensive. There is now a focus on finding a balance between profit and growth.

This has led to fewer unicorns, that were holding the torch for tech sector positivity for so long, and weaker VC returns. A good example of VC valuations under pressure would be Klarna, which raised $800 million of funds at a valuation of $6.7 billion, down around 85% from the $46 billion price-tag it attracted last year.

Given where these businesses are in their lifecycle, cash runway will drive the timing of any fundraise rather than optimising for market conditions. This has driven a buyer’s market in the VC world which is expected to continue for the foreseeable future.

But, what is happening in the mid market?

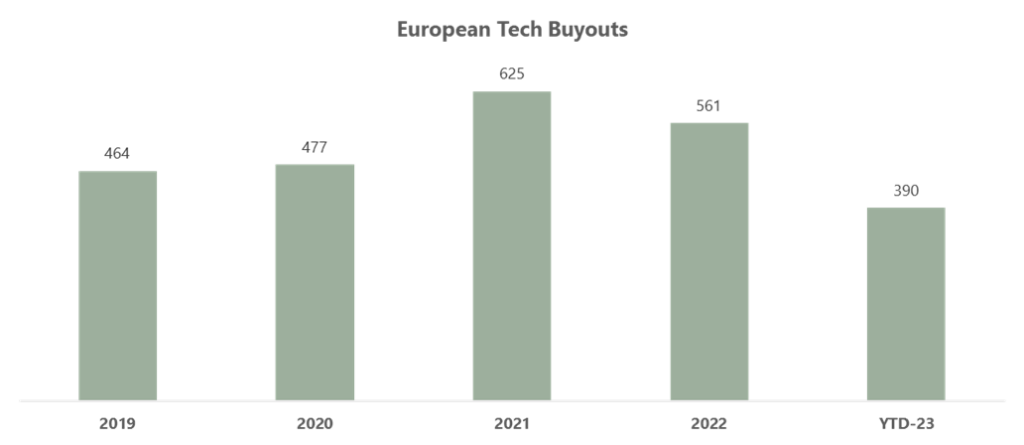

Lower volume – higher quality

The overarching theme in the mid-market is a flight to quality.

Investors are balancing a wariness about macroeconomic conditions with record levels of dry powder (including our own new £1bn fund!).

The best businesses are those that have shown resilience to a more challenging macroeconomic backdrop, evidencing their ability to perform well irrespective of where we are in the cycle.

Deal volumes are down, as investors step away from deals that don’t meet this criteria. This has created a market with a highly motivated buyer pool targeting a smaller number of transactable assets. Unsurprisingly pricing remains strong and top-quality businesses still demand a premium.

So, what does the future look like for the tech sector?

Even in the tougher big-tech/VC landscape, there are clear trends for businesses that have been able to weather the storm.

- Those that have stuck to their core business. Businesses that tried to do too many things at once were liable for more difficulty. Meta was a prime example of this, whereas Amazon’s CEO has focussed on talking more about the ‘fundamentals’ of AWS growth, as opposed to the ‘unusual growth’ of grocery.

- Those that have harnessed the power of new technologies, such as AI. For example, it is predicted that the pivot towards generative AI will propel Microsoft to a $3tn valuation. Nvidia has been another beneficiary of the AI revolution with stock up 175% YTD.

And in the mid-market, in some ways, the more things change the more they stay the same. Businesses that have strong growth, high customer loyalty, and good margins will remain attractive regardless of wider market sentiment, and in turn, attract high prices.

While the tech sector may have been living under a grey cloud for a while, the outlook is actually much brighter than the headlines suggest, and the appetite for investing in the mid-market remains as strong as ever.